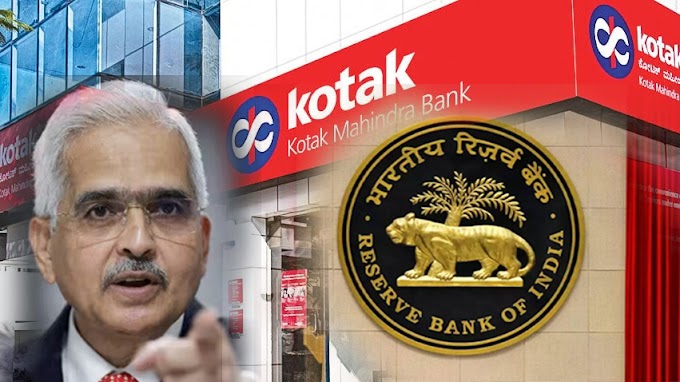

The Reserve Bank of India (RBI) took action against Kotak Mahindra Bank, barring it from onboarding new customers through online and mobile banking channels.

The regulator also directed the bank to stop issuing new credit cards This action stems from concerns identified by the RBI.

Why the RBI Took Such Extreme Step?

For two consecutive years, the bank was assessed to be deficient in its IT Risk and Information Security Governance, contrary to requirements under Regulatory guidelines.

During the subsequent assessments, the bank was found to be significantly non-compliant with the Corrective Action Plans issued by the Reserve Bank for the years 2022 and 2023.

As the compliances submitted by the bank were found to be either inadequate, incorrect or not sustained.

In the absence of a robust IT infrastructure and IT Risk Management framework,

The bank's Core Banking System (CBS) and its online and digital banking channels have suffered frequent and significant outages in the last two years,

The recent one being a service disruption on April 15, 2024, resulting in serious customer inconveniences.

What Happened on 15th April?

Several customers of the Kotak Mahindra Bank were unable to use the bank's mobile application on that day.

They took to social media to express their dissatisfaction.

Few of the customers even complained about the net banking, UPI, and debit card transactions not going through as well.

The RBI's decision to impose business restrictions on Kotak Mahindra Bank is aimed at-Safeguarding the interests of customers and ensuring the stability of the financial ecosystem.

Impact on Customers ?

For existing customers of Kotak Mahindra Bank, it's essential to note that the business restrictions imposed by the RBI do not affect the services provided to them.

Existing customers, including credit card users, will continue to receive uninterrupted services as usual.

However, potential new customers will face temporary limitations on opening accounts or obtaining credit cards through the bank's online and mobile platforms.

Impact on Bank's Business ?

Kotak Mahindra Bank has been lately embracing digital innovations in its business operations.

Around 95% of new personal loans by volume and 99% of new credit cards have been facilitated through digital channels as of the third quarter of FY24.

In Q3FY24, Kotak Mahindra Bank witnessed growth in its credit card book, with a year-on-year increase of 52% and a quarter-on-quarter rise of 10%.

This growth trajectory reflects the bank's strong reliance on digital platforms for business expansion, with the credit card book amounting

to 13,882 crore, approximately 3.9% of its total loans.

However, the recent regulatory restrictions are likely to impact its business operations.

Deepali Pant, Former Executive Director at the RBI, expressed that the bank's retail portfolio is expected to suffer setbacks.

However, she emphasised that these challenges are temporary in nature.

But How Long ?

Ashutosh Mishra, an analyst at Ashika Stock Broking, highlighted that-

Based on previous instances where the RBI has taken similar actions against banks or major payment networks like Visa and MasterCard,

The recovery process could extend up to a year or longer.

Not the First Time

This is not the first instance of the RBI taking regulatory action against a leading Indian bank for IT-related issues.

In 2020, HDFC Bank faced similar restrictions after repeated outages in its online platforms, leading to a halt in new digital launches and credit card issuances.

The RBI partially lifted the ban in subsequent months.

The restrictions will remain in place until the completion of a comprehensive external audit commissioned by the bank with the RBI's approval.

The review process will also consider observations from RBI inspections and the satisfactory remediation of identified deficiencies.

0 Comments